japan corporate tax rate 2020

Tax rates for corporate income tax including historic rates and domestic withholding tax for more than 170 countries worldwide. Japan Income Tax Tables in 2020.

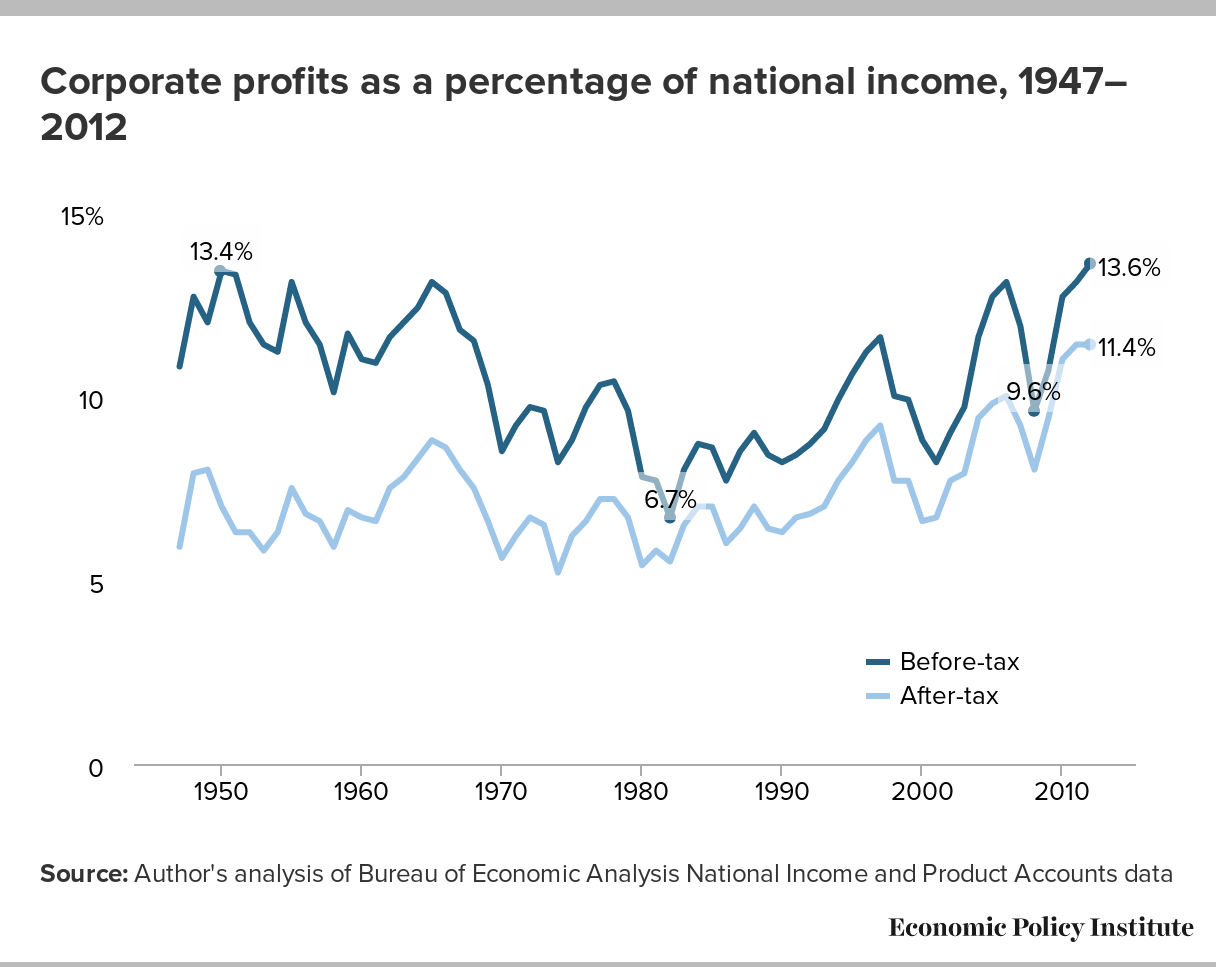

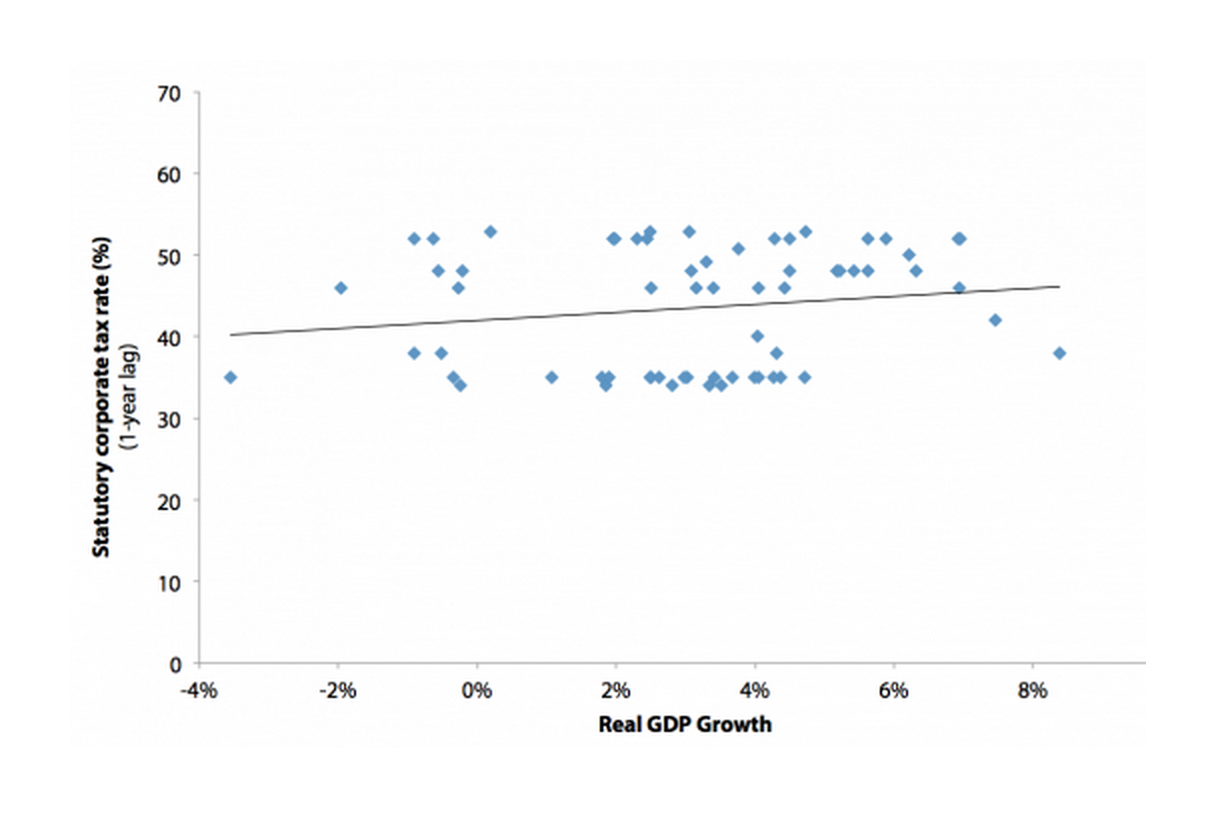

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Under the 2020 Tax Reform Act the currently effective consolidated tax regime would be abolished and replaced with a new regime of group relief group tax relief.

. Income from 3300001 to 6950000. 225 rows Since then countries have recognized the impact that high corporate tax rates have on business investment decisions so that in 2020 the average is now 2385 percent and 2585 when weighted by GDP for 177 separate tax jurisdictions. In 2020 the Japanese Corporate Tax rate for companies with established capital greater than 100 mil JPY was 232.

Income from 0 to 1950000. The Corporate Tax Rate in Japan stands at 3062 percent. 11242020 115142 AM.

Inhabitants tax local income tax. Starting a business in Japan. Indirect tax rates individual income tax rates employer social security rates and employee social security rates and you can try our interactive tax rates tool to compare tax rates by.

Last reviewed - 02 March 2022. It depends on companys scale location amount of taxable income rates of tax and the other. This newsletter provides an overview of the major amendments and revisions contained in the outline.

In Japan the Corporate Income tax rate refers to the highest corporate tax rate for companies with taxable income above 8 million JPY a year based in Tokyo. Income from 6950001 to 9000000. Data is also available for.

The local standard corporate tax rate in Japan is 234 and it applies to normal companies with a share capital which exceeds JPY 100 million USD 896387. Estimated effective tax rate including Local taxes In addition to National tax above local taxes are levied and the estimated effective tax rate for corporations in Japan is about 30 or less in average now in 2021. Corporate Income Tax filing services for foreign companies with subsidiaries in japan.

Medium and small sized company. Non-residents without a fixed place of business in Japan must appoint a tax representative to handle Ctax administration. Our company registration advisors in Japan can deliver more details related to the corporate tax in this country.

There is also Business Enterprise and Inhabitant Tax which all adds up. Multiple tax rates 10 or 8. Corporate Tax Rate in Japan averaged 4119 percent from 1993 until 2020 reaching an all time high of 5240 percent in 1994 and a record.

The maximum rate was 524 and minimum was 3062. 2 Japan tax newsletter 13 February 2020 Corporate taxation 1. The new regime will be effective for tax years beginning on or after 1 April 2022.

13 February 2020 Japan tax newsletter Ernst Young Tax Co. The tax rates applied to profit and loss sharing groups will be. Income from 1950001 to 3300000.

The tax rates for corporate tax corporate inhabitant tax and enterprise tax on income tax burden on corporate income and per capita levy. Income from 9000001 to 18000000. The Abe Cabinet continues to implement initiatives to overcome.

Note this is only the National Tax Rate. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. KPMGs corporate tax rates table provides a view of corporate tax rates around the world.

Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. The effective Japanese corporate income tax rate the total of the taxes listed above is presently 346 for companies with paid-in capital of JPY100000000 or less or 3062 for companies with paid-in capital greater than JPY100000000 including Japanese branch-offices of foreign companies with paid. Corporate tax rates table - KPMG Global - KPMG InternationalKPMGs corporate tax table provides a view of corporate tax rates around the world.

Diversity Equity Inclusion at Deloitte Japan. 2020 Japan tax reform outline. GIG is a specialist group established to respond to the various needs of foreign companies developing business in Japan.

Corporate - Group taxation. Corporate Tax Rate in Japan averaged 4083 percent from. Learn the essentials of Japans corporate tax rates and your obligations as an employer in Japan with Links International.

Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of 334 Table 3-5 applies. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. Revision of the consolidated taxation.

Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. February 7 2020. The ruling parties a coalition comprised of the Liberal Democratic Party and Komeito released an outline of the 2020 tax reforms hereinafter Outline on 12 December 2019.

Historical corporate tax rate data. Corporate Tax Rate in Japan remained unchanged at 3062 in 2021. 2021 2020 2019 2018 2017 2016 2015.

Corporate Tax Reform In The Wake Of The Pandemic Itep

日本 企业所得税税率 1993 2021 数据 2022 2024 预测

Australia Tax Income Taxes In Australia Tax Foundation

Doing Business In The United States Federal Tax Issues Pwc

Israel Corporate Tax Rate 2022 Data 2023 Forecast 2000 2021 Historical Chart

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Corporation Tax Europe 2021 Statista

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

International Corporate Tax Reform Dgap

Real Estate Related Taxes And Fees In Japan

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Poland Tax Income Taxes In Poland Tax Foundation

What Would The Tax Rate Be Under A Vat Tax Policy Center

Corporate Tax Reform In The Wake Of The Pandemic Itep

Real Estate Related Taxes And Fees In Japan

Real Estate Related Taxes And Fees In Japan