montgomery al sales tax form

Deductions are to be itemized on back of form. You will be redirected to the destination page below in 1.

Get And Sign Printable 40nr Alabama 2018 Form

1 lower than the maximum sales tax in AL.

. Alabama Business Privilege Tax Return. Find a list of tax forms and applications to properly register your business within Montgomery. City of Montgomery Sales Tax.

Rental Tax Return- City. Fillable PDF forms require Adobe Acrobat Reader. CITY OF MONTGOMERY ALABAMA Sales Tax Sellers UseConsumers Use Tax Police Jurisdiction Form Tax Period.

County SalesUse Tax co Sarah G. Police Jurisdiction Sales Tax. In completing the CityCounty Return to filepay Montgomery County you must enter in the Jurisdiction Account Number field of the return.

26 rows Alabama Business Privilege Tax Return and Annual Report for Pass Through Entities Only Instruction. Thank you for visiting the Montgomery County AL. _____ Check here for any changes in business_____ and.

The 10 sales tax rate in Montgomery consists of 4 Alabama state sales tax 25 Montgomery County sales tax and 35 Montgomery. City of Montgomery This form combines sales and sellersconsumers use tax reporting. This form is used to apply for a Sales Tax Permit Use Tax Permit Off-Road Heavy Duty Diesel Powered Equipment Surcharge Telecommunications Infrastructure Fund Assessment.

Instructions for Uploading a File. The current total local sales tax rate in Montgomery AL is 10000. The local tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales.

However However pursuant to Section 40-23-7. Sales Use Tax Division. The December 2020 total local sales tax rate was also 10000.

Interest For questions or assistance phone. The calculating functions will not work with the Google Chrome and Microsoft Edge built-in PDF reader. The Montgomery County AL is not responsible for the content of external sites.

650 Is this data incorrect The Montgomery County Alabama sales tax is 650 consisting of 400 Alabama state sales tax and 250 Montgomery County local sales. 1000 Is this data incorrect Download all Alabama sales tax rates by zip code. All returns with zero tax payment or SEBP 702 Any correspondence should be mailed to.

Form PPT with Calculations. Alabama Department of Revenue. State Sales and Use.

Box 1111 Montgomery AL 36101-1111 4. State Sales and Use Tax Certificate of Exemption Form STE-1- Issued For Wholesalers Manufacturers and Other Product Based Exemptions. To report a criminal tax violation please call 251 344-4737.

To report non-filers please email. The Montgomery Alabama sales tax is 1000 consisting of 400 Alabama.

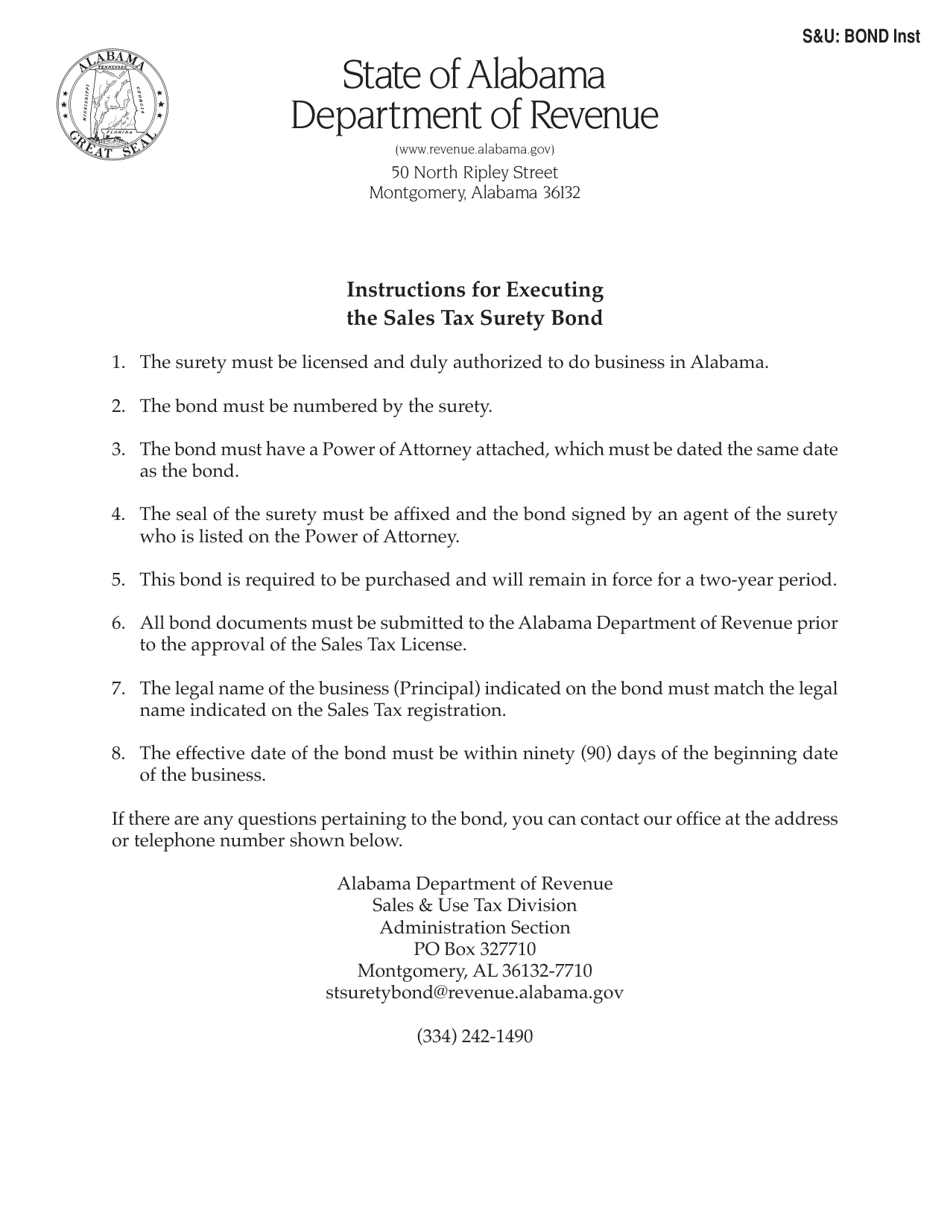

Download Instructions For Form S U Bond Sales Tax Surety Bond Pdf Templateroller

Fill Free Fillable Forms State Of Alabama

2001 Form Al St Ex A2 Fill Online Printable Fillable Blank Pdffiller

Hank Williams Sr Bobbie Jett Copy Of Paternity Agreement 1952 Montgomery Alabama Ebay

Alabama Sales Tax Guide For Businesses

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZBPMBUXJJZHEPN3UWKXDU7KZX4.jpg)

Alabama Has Severe Weather Tax Free Holiday Weekend

Pennsylvania Sales Tax Guide For Businesses

Revenue Department Clarifies Tax Exempt Sales Notice Alabama Retail Association

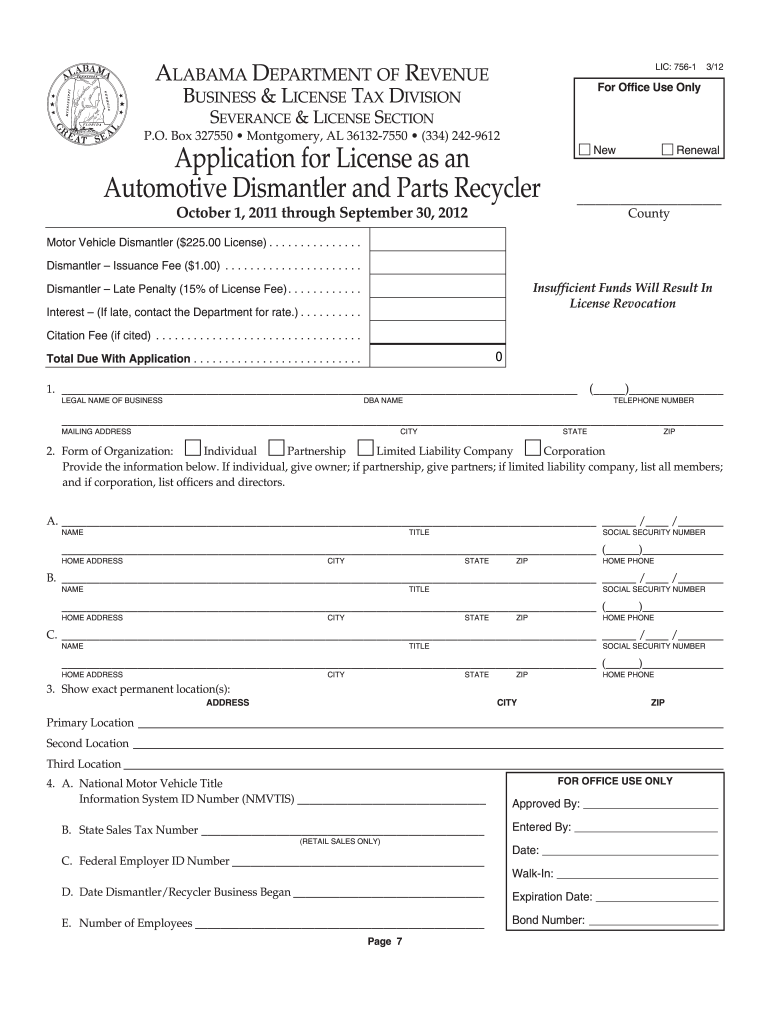

Al Ador Lic 756 1 2012 2022 Fill Out Tax Template Online Us Legal Forms

Sales Tax Alabama Department Of Revenue

Form 40a Alabama Individual Income Tax Return Short Form

Maintenance Districts Montgomery County Al

Other Alabama Taxpayer Forms Avenu Insights Analytics Taxpayer

Sales Tax Alabama Department Of Revenue

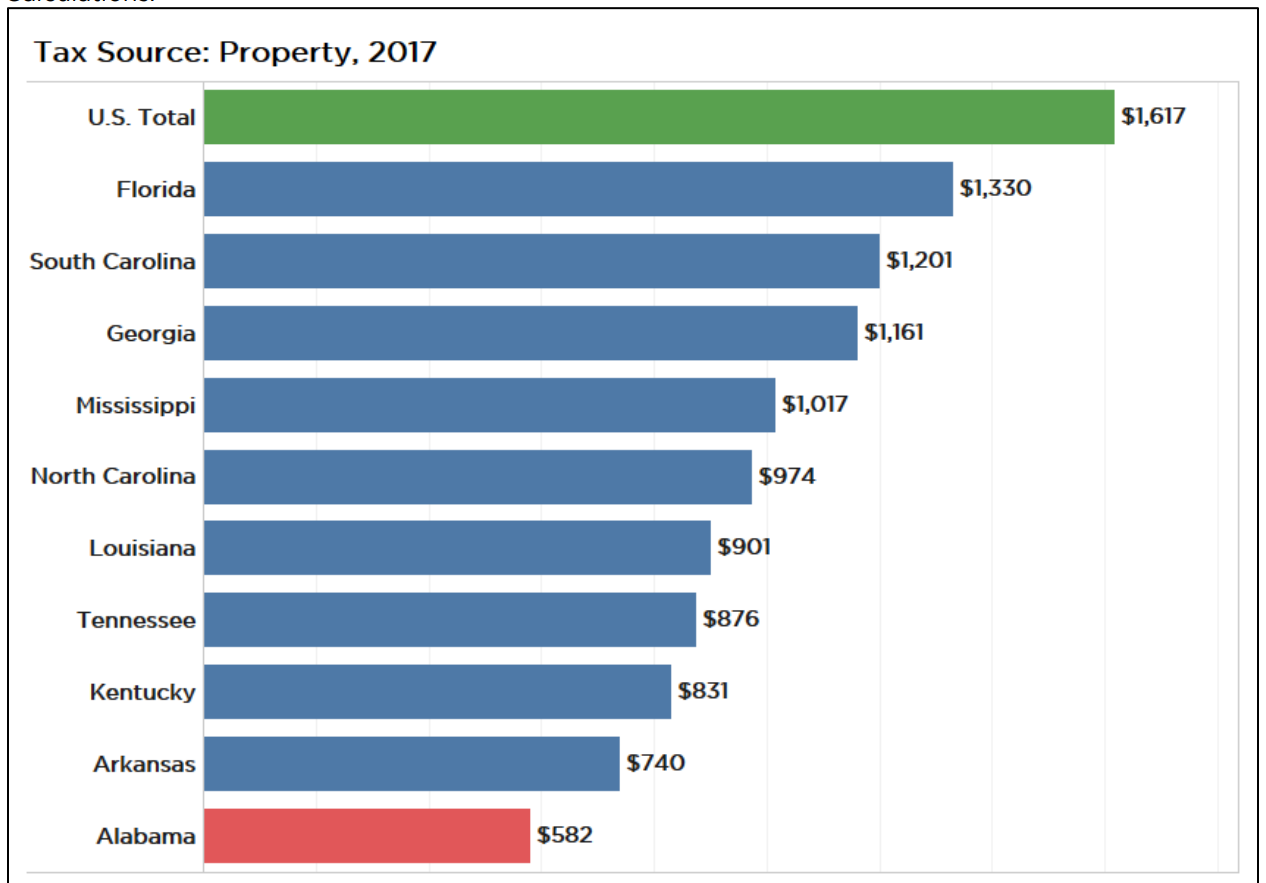

Why Alabama S Taxes Are Unfair Al Com

Prepare And Efile 2021 Alabama State Income Return In 2022

Alabama Sales Tax Guide And Calculator 2022 Taxjar

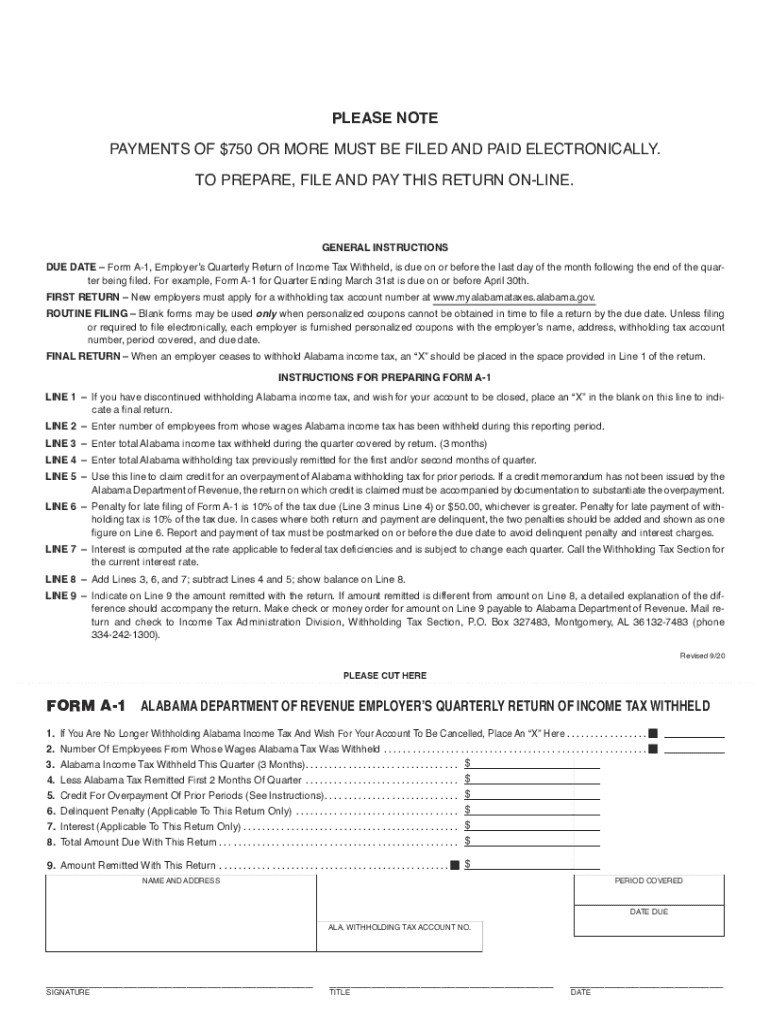

Al A 1 2020 2022 Fill Out Tax Template Online Us Legal Forms

How To Get An Alabama Sales Tax License Alabama Sales Tax Handbook